ahm Private Health Insurance Review

ahm was founded in Wollongong in 1971. The fund was acquired by Medibank in 2009 and has over 600,000 members. In 2011 ahm was voted Best Health Insurer in the Australian Financial Review’s Smart Investor SMILES Survey 2011/12.

ahm aims to offer straightforward private health insurance by providing clear, simple policies to its customers. The fund also has a digital-first focus, supported by its mobile-friendly webpage and customers’ ability to make certain claims online.

Awards

ahm was voted Best Health Insurer in 2011 in the Australian Financial Review’s Smart Investor SMILES Survey 2011/12.

- With selected ahm Health Insurance packages, members can combine extras limits into a single annual limit to use however you want on the included extras.

- Members can use their ‘flexi’ Extras limits for the included services that are most important to them – this can be spent on a single Extras service or spread across a few, for example.

ahm offers four main types of private health insurance for Australians, plus the ability to design your own cover. In addition, ahm offers Overseas Health Cover (OSHC) to international students studying in Australia.

Hospital and extras packages

ahm offers combined hospital and extras cover to get what you want all in one policy. All of ahm’s pre-made packages include one limit to spend how you choose as well as loyalty rewards.

Hospital cover

ahm’s hospital policies all include ambulance cover, hospital accommodation, and operating theatre fees. There are six levels of hospital-only cover:

- White Starter: Basic cover for accidents

- White Lite: Basic cover + joint reconstructions and wisdom teeth removal

- White Boost: Most hospital procedures

- White Classic: Mid-range hospital cover with inclusions for cancer therapies, heart procedures, and colonoscopies. No excess for kids.

- White Deluxe: Includes joint replacements, major eye surgery, rehab, and more. No excess for kids.

- Top: Highest level of hospital cover and includes obstetrics and reproductive services.

Extras cover

Choose from five levels of extras cover, all of which include unlimited emergency ambulance and no gap dental check up at select dentists. You’ll also be free to choose your providers.

- Basic: Set benefits for a range of essential extras services

- Black 50: Get 50% back up to annual limits for basic extras

- Black 60: Get 60% back on dental and physio, and 100% back on optical up to annual limits.

- Lifestyle: Full dental, natural therapies, and additional benefits.

- Family: Dental, pre- and post-natal services and much more

- Super: Maximum amount of extras along with unlimited routine dental services.

Pregnancy cover

Not sure how much pregnancy cover you need? ahm gives you two packages of hospital + extras cover. There is a 12 month waiting period before you can claim private cover for pregnancy.

- White Boost:Mid level hospital and extras, Partial cover for obstetrics, Excludes reproductive services

- Top: Full coverage, including obstetrics, labour ward, and reproductive services.

Add-on options

Customise your health cover by tacking an extras policy to your preferred level of hospital cover.

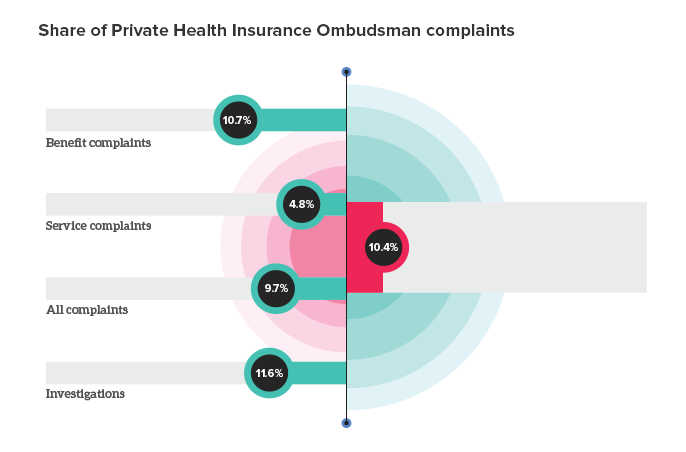

According to the Private Health Insurance Ombudsman (PIHO), here’s how ahm stacks up against other funds in the industry.

Hospital Related Charges Covered

ahm is slightly below industry average

Medical Services with No Gaps

ahm is slightly below industry average

Medical Services with No or Known Gaps

ahm is above industry average

General Treatment (Extras) Covered

ahm is above industry average

*As of March, 2018

AHM’s digital-first approach makes the claims process more streamlined. The required claims forms mentioned below are available for download from the ahm website. Note that services with a date greater than 2 years old are no longer eligible to be claimed.

Making an Extras Claim

- On the spot: Use your ahm member card after your appointment to claim electronically.

- Online: Log in to your member account to claim through the ahm website.

- Email: Download a claim form and email the completed copy to info@ahm.com.au.

- Post: Download a claim form and post it to ahm.

Making a Hospital Claim

- If you receive a bill from your specialist, fill in a Medicare claim form and a Medicare Two-way claim form. Medicare processes the forms first, then sends it over to ahm.

- If you receive a Medicare Statement of Benefits, fill in an ahm claim form and send it to ahm along with the Statement, either by email or by post.

ahm offers special rewards to its members to promote good health and wellbeing. Check the fund’s websites for up-to-date information on available rewards. New members may also be able to take advantage of one-off promotional offers, such as waived waiting periods and one month free.

ahm member rewards may include:

- 2 for 1 ‘date night’ tickets Thursday nights at HOYTS Cinemas

- 15% off Active Plus memberships at Goodlife Health Clubs

- Partner discounts on travel, pet, home, and car insurance

- 25% off a range of Fitbit trackers

- 25% off a single pair of glasses at Specsavers

- 20% off 12WBT with Michelle Bridges

Address: ahm health insurance, Locked Bag 4, Wetherill Park NSW 2614

Phone: 1300 134 246

8am – 7pm Monday to Friday (AEDT)

Website: http://www.ahm.com.au

Email: info@ahm.com.au

Twitter: @ahmhealth