Still have questions? Let's talk!

Confused? Not sure if this applies to your situation? Phone us on 1300 163 402 for some free, no obligation advice.

Thinking of undergoing cosmetic surgery? You may be wondering whether you’ll receive financial assistance from your health insurer. This depends on your insurance policy (or plan), and the purpose for your surgery.

Your answer will largely depend on whether your surgery is cosmetic or medically necessary.

Contents

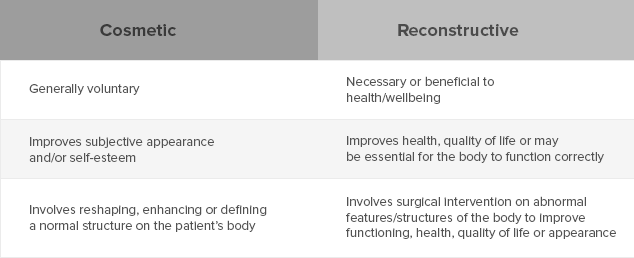

In most cases, cosmetic surgery is not needed to improve health or maintain the body’s normal functioning. Patients will elect to have the surgery done – it is an option rather than a necessity.

A patient may feel unhappy with a particular feature of their appearance and wish to change this via surgical intervention. The end goal is to improve a patient’s self-esteem and/or subjective appearance.

Medically necessary surgery, on the other hand, may be required to maintain a patient’s normal functioning. Medically necessary surgery may also seek to preserve or improve a patient’s quality of life through ‘fixing’ abnormal structures.

Abnormal bodily structures requiring say, reconstructive surgery may be caused by one of the following factors:

Key Differences Between Cosmetic and Reconstructive Surgery

Your surgeon will determine if your surgery is purely cosmetic or if it is medically necessary

For this reason, it’s always best to check with your surgeon and your fund to determine whether financial assistance will be available for your procedure. If you are currently shopping around for a policy, and have cosmetic or reconstructive surgery in mind, it’s a good idea to check your policy has the inclusions you are after.

Surgeries that may be covered by Medicare and private health insurance include:

If your surgery is elective rather than medically necessary, it is not likely to be covered by Medicare or health insurance. Some of these procedures include:

There are exceptions to nearly everything in life, and that includes cosmetic surgery.

For example, consider the following case:

In some circumstances, breast reductions may also be necessary in order to reduce back pain and improve quality of life. In these cases, your health fund may cover the surgery in part or full.

It’s important to note that not all medically necessary surgeries are covered by your private health insurer. That’s why it’s important to check your policy restrictions and exclusions before you purchase a policy. And unless a no-wait period is present on your private health insurance plan, keep in mind the time between when you add or change coverage, to the day cover has become active.

If you have a policy that does not cover the surgery you need, you may want to shop around for a new one and compare current policies out there. Keep in mind that even if a policy claims to cover reconstructive procedures, some specific surgeries may be excluded. If you are unsure, contact the health fund to find out more.

If you do switch policies, you may have to reserve waiting periods before you are able to make a claim and have your surgery performed.

While private insurer Bupa does not cover elective cosmetic surgeries, many of their policies cover medically necessary ones.* The insurance carrier also boasts a no wait period for holders in the case of an accident or medical emergency after joining. This means, if your policy has a 30-day wait period to access certain benefits, you may be able to bypass this period in the case of an immediate need for medical care.**

Per the Bupa’s website, an accident is:

“[A]n unforeseen event, occurring by chance and caused by an unintentional and external force or object resulting in involuntary hurt or damage to the body, which occurred in Australia, and requires, within 72 hours of the event, medical advice or treatment from a registered practitioner other than the policy holder and, if necessary, any further medical treatment where such admission (including any readmission) or treatment must be within 180 days of the event.”***

There is no straightforward answer regarding cosmetic surgery coverage under Medibank, but the company’s website does elaborate on its plans that include “extras” coverage. One main benefit for policyholders of Medibank’s “extras” is the non-Pharmaceutical Benefit Scheme (non-PBS). This means in some policies, the insurer will cover a fixed rate for prescribed drugs that are otherwise not subsidised by the Australian government. Per Medibank’s member guide, some of those covered include:

It’s important to remember that even partial coverage by your private insurer can still leave you responsible for copayments and deductible amounts depending on the services rendered.****

Another perk of Medibank is the no-waiting period when you change your benefits cover from an outside plan that you have already served a waiting period for. You must join Medibank within two months of leaving your previous Australian health fund and provide proof of serving a previous waiting period and any benefit payouts.*****

Confused? Not sure if this applies to your situation? Phone us on 1300 163 402 for some free, no obligation advice.

Our experts can provide you with free personal advice. Let us call you.