Still have questions? Let's talk!

Confused? Not sure if this applies to your situation? Phone us on 1300 163 402 for some free, no obligation advice.

Key Points

Contents

The Lifetime Health Cover (LHC) loading is an initiative launched on 1 July 2000 by the Australian government to encourage people to take out hospital cover from a younger age. Having appropriate private health cover helps alleviate the burden on the public system, plus it provides peace of mind and cover for a broader range of options than Medicare alone.

LHC loading applies to hospital cover. It does not apply to extras cover or ambulance cover. LHC is a financial loading applied on top of your base rate premium.

The following types of cover are not considered hospital cover for LHC purposes:

To understand if you need to pay the LHC loading, you first need to determine your LHC base day.

Your LHC Base Day Is the 1st of July Following Your 31st Birthday

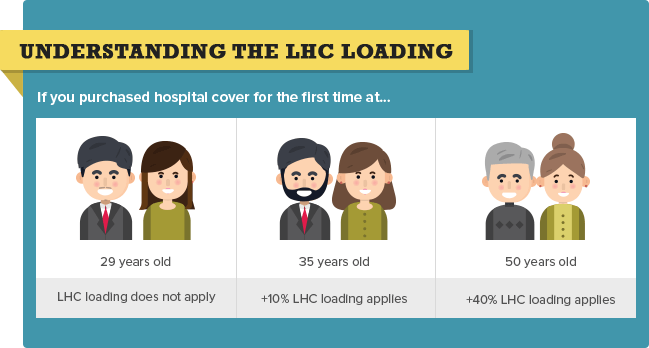

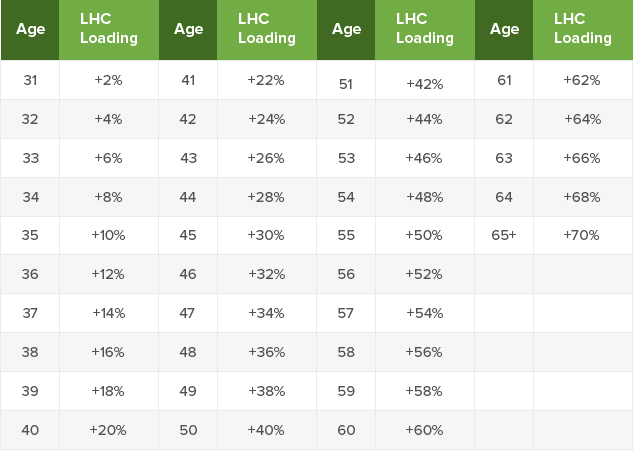

If you don’t have hospital cover on your LHC base day, LHC loading will apply when you eventually join health insurance. The loading is added on top of your premium as an extra 2% for every year you are aged over 30.

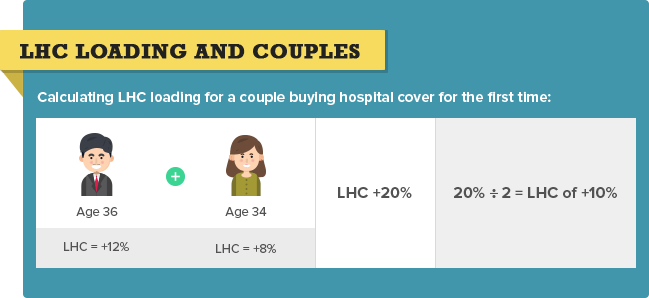

For couples, LHC loading is calculated by adding up your individual LHC loading rates and dividing the sum in half.

Some people try to avoid LHC loading by not purchasing hospital cover altogether. This could be a risky move because your health circumstances are likely to change as you get older. Hospital cover can provide a wider range of health care options and more comprehensive cover.

The Australian government also provides rebates for private health insurance to help reduce the cost of your premium. If you skip out on health cover, you could be putting your healthcare options at risk. What’s more, you could be hit with the Medicare Levy Surcharge, an extra tax for people without hospital cover who earn over a certain amount.

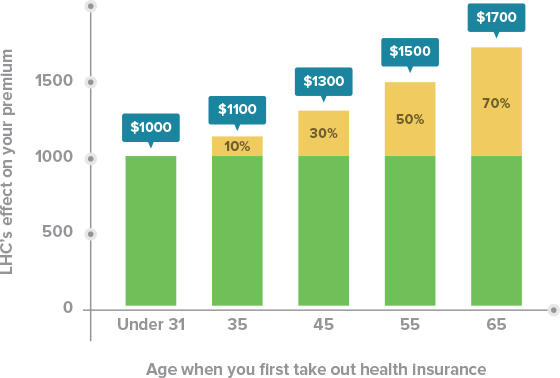

The longer you wait to take out hospital cover, the higher your LHC loading will be. The following table is an illustrative example of how LHC affects a base annual premium of $1000.

LHC and Premium Payments

If you wait until after your LHC base day to buy hospital cover, the LHC loading will kick in. The only way you can get rid of it is by holding eligible hospital cover for 10 continuous years. After 10 years of continuous membership, the LHC loading will be removed from your cover and your premium will reduce to the base premium.

Is LHC Loading Capped?

Yes. LHC loading increases by 2% each year, but it is capped at 70%. People who take out hospital cover for the first time when they are 65 or older will pay a LHC loading of 70%.

People born on or before 1 July 1934 are exempt from the LHC loading and can purchase health insurance at any time without a loading fee.

Migrants are still liable for the LHC loading, however the rules are slightly different. For new migrants to Australia, the latter of the following also applies:

Migrants who do not buy hospital cover by the required day will have to pay a loading fee of 2% for every year they are aged over 30 (and did not have cover) when they do eventually take out cover.

The government offers an income-tested premium rebate on hospital, general, and ambulance policies. However as of 1 July 2013, the rebate does not apply to the LHC portion of your hospital cover. Rebates will still apply to your hospital cover’s base premium.

It’s understandable that you might find yourself with temporary gaps in cover, and the LHC has made provisions to allow for this.

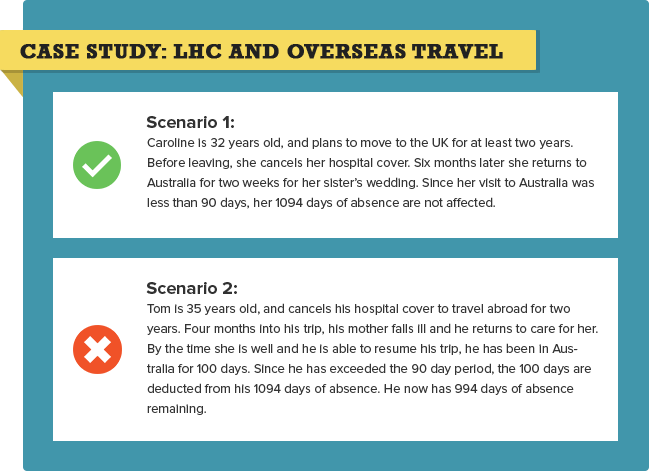

You can be without hospital cover for a total of 1094 days—one day short of three years—without it having any effect on your LHC loading.

For example, these ‘days of absence’ could help in the following situations:

If you use up your 1094 days, LHC loading will apply when you next purchase hospital cover. The 1094 days of absence are over your lifetime and the period cannot be renewed.

If your health insurer agrees to temporarily suspend your membership, that time period is not taken out of your 1094 days. The ability to suspend your membership is up to your health fund.

If you cancel your health insurance after your LHC base day to go overseas for a minimum of one year, your time overseas does not apply to your 1094 days of absence. During your time abroad, you can return to Australia for up to 90 days at a time without affecting your days of absence.

Special circumstances apply to the following people.

The ADF provides medical services to members of the ADF, which is considered the same as having hospital cover.

If you discharge from the ADF after your LHC base day:

If you discharge from the ADF before your LHC base day:

DVA Gold Card holders are considered to hold hospital cover. If you have been a cardholder at any point since 1 July 1999, even if the DVA subsequently withdrew the card, you can claim that period as having had hospital cover.

If you are overseas on your LHC base day, you have until the first anniversary of the day you returned to Australia to purchase hospital cover. You can come back to Australia for up to 90 consecutive days and still be considered overseas.

Special circumstances apply to Australian citizens and permanent residents who were over 31 and resided overseas on 1 July 2000, the day LHC first took effect in Australia. In this case, you are considered to have had hospital cover on your LHC base day.

You can return to Australia for 90 days at a time without tapping into your 1094 days of absence; however, once these days are used up you will be liable for LHC loading if you have not yet purchased hospital cover.

Portability laws allow you to switch hospital funds at any time without re-sitting any waiting periods. This lets people shop around and take advantage of better deals on health insurance without sacrificing coverage. If you do switch funds, remember to request a Clearance Certificate from your old fund.

The Clearance Certificate provides proof of your cover for LHC loading purposes. It ensures that your new fund applies the correct loading (if any), and does not charge you as if you were buying hospital cover for the first time.

Confused? Not sure if this applies to your situation? Phone us on 1300 163 402 for some free, no obligation advice.

Our experts can provide you with free personal advice. Let us call you.