Still have questions? Let's talk!

Confused? Not sure if this applies to your situation? Phone us on 1300 163 402 for some free, no obligation advice.

Nobody likes going to the dentist. And thanks to expensive treatments, the bill is often the most painful part of your visit. While Medicare is great for GP visits, it doesn’t offer cover for dental care.

But if you’ve got the right dental insurance to suit your life stage, you can protect your pearly whites. All at a price that will put a smile on your face when you look at your bank balance.

In this guide, you’ll learn what’s covered under dental extras and what’s not, and the difference between what the industry terms as major and general dental, so you can choose a plan that’s right for you.

Contents

So, first off, dental insurance isn’t really a thing in Australia. If you’re looking for dental insurance, it’ll probably come under your extras cover – these are services that typically aren’t covered by Medicare or private hospital insurance. You’ll probably purchase dental cover in an extras package along with other extras like physio and optical.

That said, if you need dental surgery that requires a hospital stay, then this will likely come under your hospital cover. Typically, if you have a silver policy, this will include dental surgery.

Yes, it can be a bit confusing. But the main thing to know is that things like dental check ups, x-rays, minor fillings, root canals and orthodontics (or your child’s braces in more everyday language) are all extras.

What level of extras really depends on what you need. But taking care of your teeth, and regular check-ups, are something every Australian will need. Beyond that, you’ll probably have a good idea of what you need and can afford.

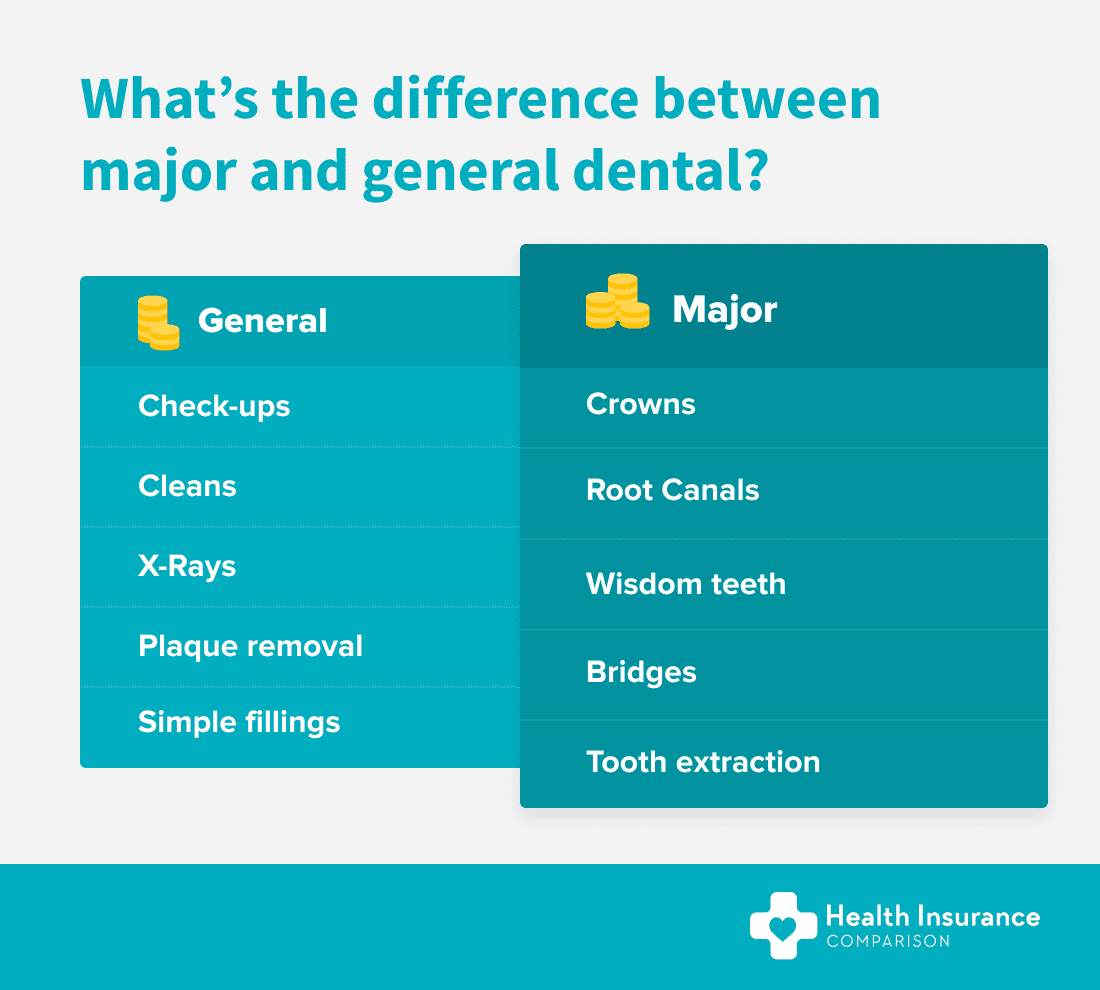

Insurers usually classify dental extras into two categories: general dental and major dental.

Everyone’s dental needs are different.

If you’re a twenty something single with healthy teeth, you may be happy with basic check-ups and cleans. And a family might also want to cover orthodontics, while seniors may need crowns, implants or dentures.

Whatever your needs, there’s plenty of options across health funds to cover your teeth. Let’s break this down into what you can expect from general dental cover and major dental cover.

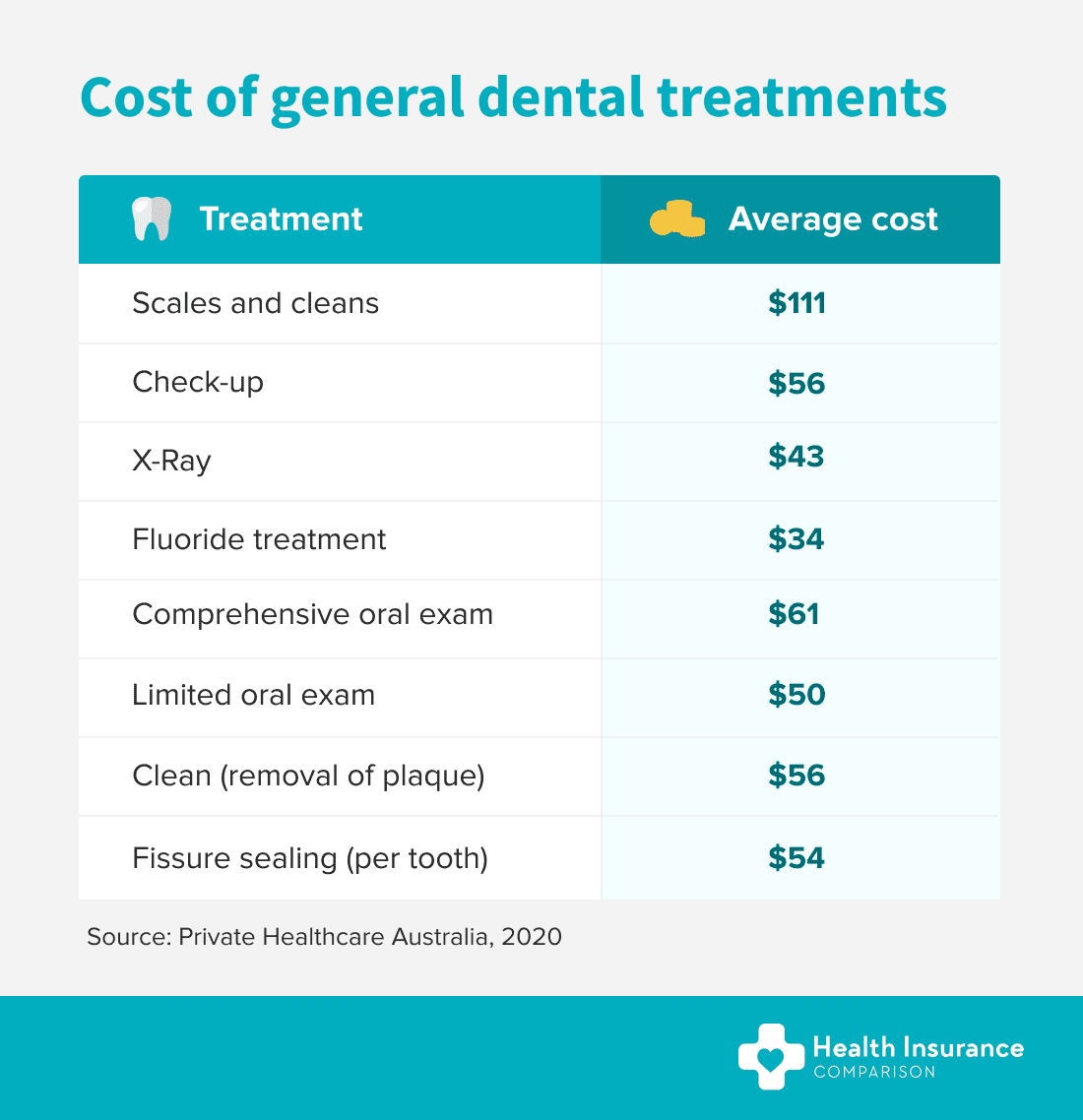

General dental covers the more preventative end of looking after your teeth. Half-yearly check-ups, cleans, plaque removals, x-rays, and simple fillings would all come under this area. In other words, the standard procedures you’d expect from a trip to the dentist.

Maintain a regular schedule with your dentist, and you’re less likely to need major treatments down the track. This is a popular choice for healthy young singles who’ve not got a history of tooth trouble.

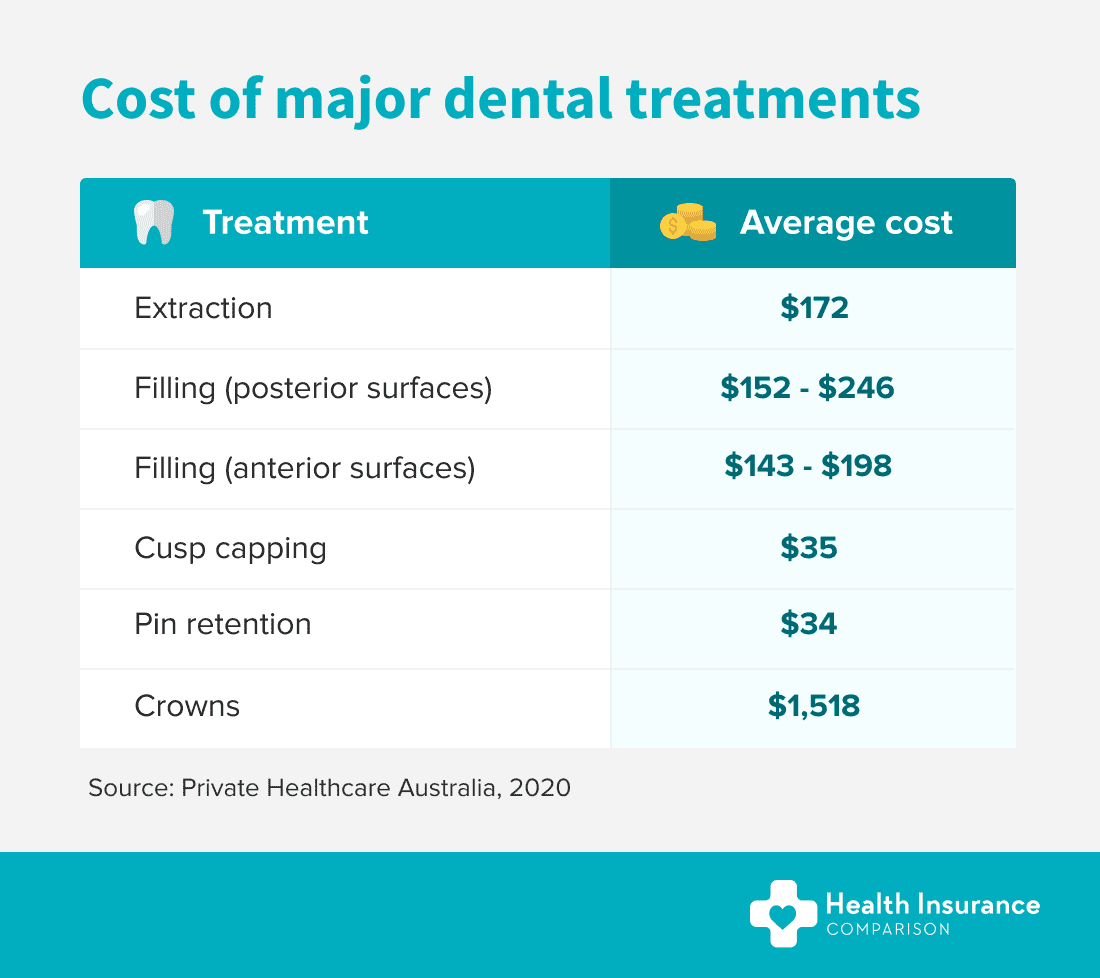

Major dental covers the more serious – and seriously expensive – treatments. Root canals, crowns, and wisdom tooth removal all fall under this area.

They’re painful treatments at the best of times and they’re seriously painful on your pocket.

If you’re receiving government benefits, the public system isn’t great at providing speedy treatment. For example, if you need a bridge, crown or fixing a chipped tooth, you could be waiting up to 12 months for public healthcare treatment in New South Wales*.

Families and seniors often choose major dental as part of their health insurance, which will include additional health services they’re likely to need. If you need major dental treatment, it can end up costing you thousands of dollars, as you can see from the table below.

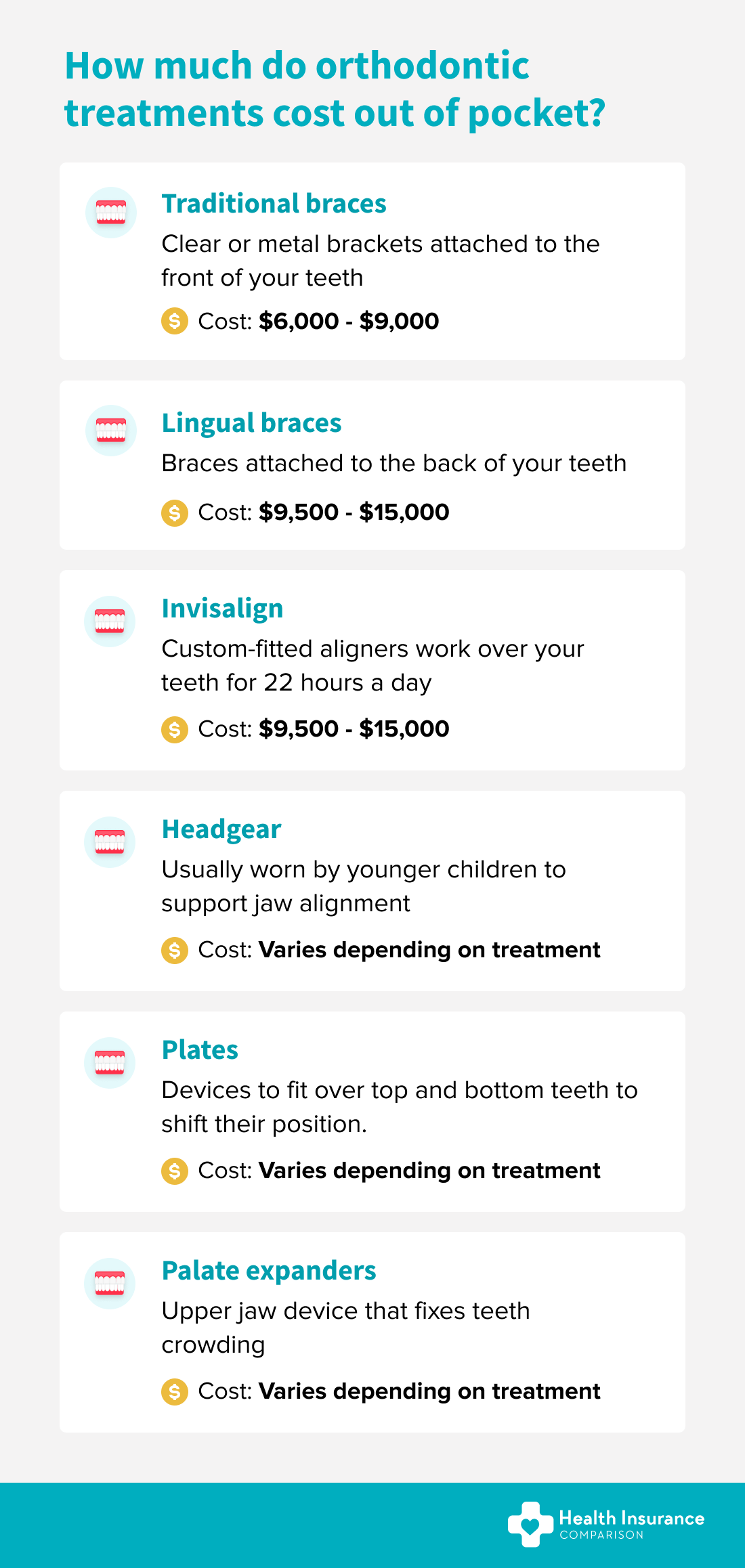

There’s also Orthodontics, which covers the expensive business of straightening your teeth. Braces, retainers, palate expanders, lip and cheek bumpers, and headgear comes under this area.

These are incredibly expensive, whether you’re correcting your child’s teeth or your own teeth, and can cost anywhere between $6,000 and $15,000.

A lot of health funds will include orthodontics under major dental, while others may have a separate category for orthodontics.

Orthodontics is a complex and expensive part of health cover, so we’ve created a separate guide just about getting your teeth straightened. You can read it here.

As you can see, it’s worth working out what you’re likely to need and what you don’t need. If you’re an empty nester with adult children, you probably won’t need orthodontics, for example.

Unsurprisingly, the more you pay in premiums, the more you’re covered for.

The cost is going to be different for everybody, depending on your needs. If you’re comparing policies, it is a good idea to talk through your needs with an expert, like the team at Health Insurance Comparison.

Generally, prices will vary, based on your state and the level of cover you choose. A family with two young children or a pensioner needing dentures will probably pay more than a single person in their late 20s with a relatively healthy set of teeth.

That doesn’t mean you should overpay though. Comparing is one way to ensure you get the cover you need at a price that’s affordable to you.

Click below to start comparing plans and prices.

That depends on your policy. While 60% or 75% rebates are common, some funds offer up to 100%, often referred to as ‘no gap’.

No gap means if you have comprehensive extras cover with no gap dental, you won’t pay a cent for general dental services. Not all funds offer this option, so it’s worth doing a comparison.

A known gap is the difference between the bill cost and what you can claim back. Let’s say you’re on a plan that gives you 75% back on dental. If you get a bill for a filling that costs $100, the known gap is 25%, which means you’ll pay $25.

Some of the larger insurers will offer a 100% rebate when you visit their preferred providers. However, it’s worth noting that their preferred provider may not be local to you.

In this instance, you’ll need to decide if the cost of a more expensive policy is worth the convenience of visiting your local dentist.

This is where you can get really stung, especially if you’re thinking of making a claim in the near future. All health funds have waiting periods when you first join extras cover, where you can only claim for dental services after you’ve been signed up for a set time.

While you’ll usually wait a couple of months to claim on general dental, major dental and orthodontics waiting periods are often a year… or more.

The reason that some of the major dental and orthodontic waiting periods are so long is to keep premium costs low. It’d quickly become expensive and unsustainable for insurers to take on new customers who then immediately put in a root canal or braces claim.

When it comes to dental, it pays to think about your future needs and look for a policy that may suit your needs in a year’s time rather than today, especially if you’ve got young children. But there are ways to minimise some of the pain.

Firstly, if you’ve already got a policy that covers dental extras, you can switch to a cheaper equivalent policy without having to serve new waiting periods.

So if you’ve still got a month left to serve on your major dental extras, and you switch to equivalent cover, you’ll only need to serve that remaining month, rather than starting your waiting periods from scratch. And if you’ve already served your waiting periods, then there could be serious savings to be made.

In addition, health insurers often have promotions where they waive or reduce waiting periods, so keep an eye out for special deals. You can see the current offers from the trusted insurers on our panel here.

No. Medicare generally only reimburses you for medical costs such GP appointments, specialist fees and tests.

That said, if you need dental surgery as part of an emergency medical procedure – say removing a tooth to set a broken jaw – the initial treatment would be covered under Medicare. However, in an emergency, you probably can’t choose your preferred surgeon, even with hospital cover.

Planned dental surgery is where your major dental (extras) cover would fit in. If you’ve got dental surgery in your hospital policy, then you’ll be covered. Not only can you choose your oral surgeon, you won’t need to pay out more than necessary for a gap fee.

Either way, any follow-up dental costs would be your responsibility to cover.

If you’re receiving a government benefit such as JobSeeker, Disability Support or the Age Pension, you’ll already have access to free dental care through the public system. Children are also covered under the Child Dental Benefits Schedule.

For a list of public clinics in your state, please see below.

Keep in mind waitlists can be quite long.

If you need emergency dental treatment for things like uncontrolled bleeding or swelling, you may be better off contacting your local dental clinic or hospital emergency department for free treatment.

In Australia, we’re encouraged to add dental cover to our hospital policies through an extras plan.

But keep in mind extras cover usually includes services like physio, chiro, optical and more, so it’s worth crunching the numbers to find a policy that gives you the best value for your overall health.

You could be better off with a combined extras and hospital policy, for example, rather than taking out multiple policies with multiple insurers.

Given there’s more than 35 insurers across Australia, it’s a long process to research dental policies. That’s why it can save you time – and money – to go through a comparison service.

For example, our experts at Health Insurance Comparison will search for a suitable policy for your dental – and other health needs – across our panel of trusted insurers.

Ultimately, whether you’re 18 or 80, your teeth need to be protected. Choosing the right dental cover needn’t break the bank and can keep you smiling for many years to come.

This guide is opinion only and should not be taken as medical or financial advice. Check with a financial professional before making any decisions.

References:

SBS: Australia’s Dental Care, May 2020

Private Healthcare Australia, Dental Health Insurance, 2020

Orthodontics Australia, How Much Do Braces Cost, 2020

*NSW Health, Priority Oral Health Program, 2017.

Confused? Not sure if this applies to your situation? Phone us on 1300 163 402 for some free, no obligation advice.

Our experts can provide you with free personal advice. Let us call you.