Still have questions? Let's talk!

Confused? Not sure if this applies to your situation? Phone us on 1300 163 402 for some free, no obligation advice.

If you’ve ever looked into the cost of getting braces or teeth straightened, the shock of the cost can be more painful than the procedure. Yes, orthodontic treatment can be incredibly worthwhile, especially for children, but it’s not cheap.

Fortunately, many health funds have extras cover for orthodontic treatments like braces, Invisalign, plates and more, which can cut your out-of-pocket costs.

So, whether you’re looking for insurance that covers orthodontic treatment for your children or yourself, there are a lot of options out there. Here’s a rundown of how health insurance for orthodontics works and what to consider when choosing a policy.

Contents

Orthodontics is a special type of dentistry that focuses on diagnosing, preventing and correcting misaligned teeth and jaws. If you ever had braces fitted when you were younger, then you’ll have had orthodontic treatment.

Why do we need orthodontics? Essentially the right treatment gives you straighter teeth but also will help prevent plaque build-up in areas where teeth were once crowded. This can mean better oral health and less dental bills in the long run.

If you need orthodontic treatment, a general dentist will usually refer you to a specialist orthodontist.

An orthodontist goes through additional dental training similar to how a doctor studies to become a surgeon or a specialist.

Orthodontists deal with:

The good news is there’s a wide range of treatments orthodontists use to help treat issues with misaligned teeth or jaws. The bad news is they’re not cheap and can cost you thousands of dollars in out-of-pocket expenses.

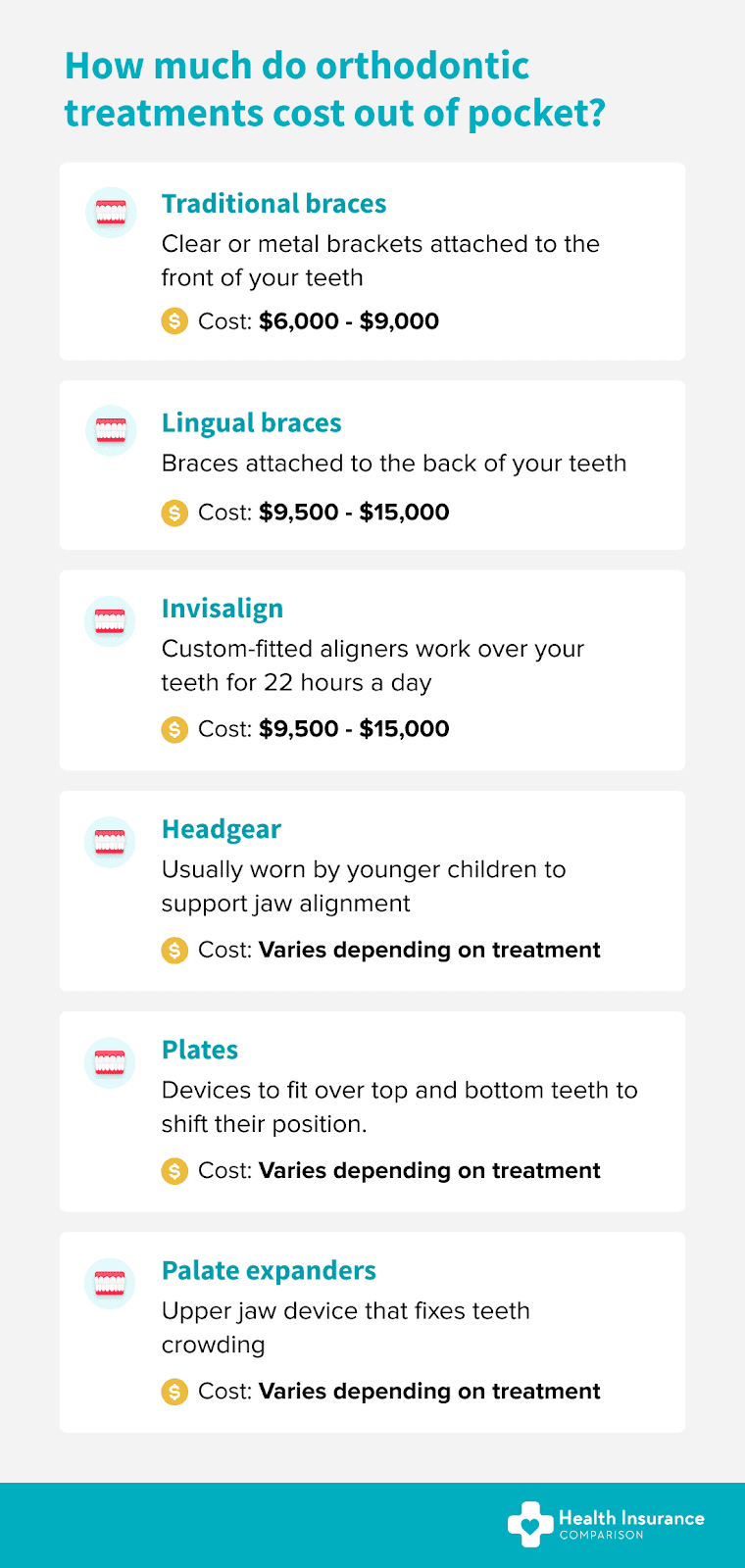

Some of the most common treatments include*:

Traditional braces: Clear or metal brackets attached to the front of each tooth with wire threaded through them. Typically an orthodontist tightens braces every 4-6 weeks and the pressure shifts teeth into the correct position.

Typical out-of-pocket cost: $6,000 – $9,000*

Lingual braces: Braces attached to the back of teeth, so they’re not visible from the front. Lingual braces function the same way as traditional braces except they’re usually made of gold, which makes them more expensive.

Typical out-of-pocket cost: $9,500 – $15,000*

Invisalign: Clear aligners that are custom-fitted and worn over the teeth. You’re usually required to wear Invisalign aligners for around 22 hours a day, and they can be removed to eat, drink and brush your teeth.

Typical out-of-pocket cost: $6,500 – $9,500*

Headgear: Devices with external parts over the head, chin or neck, usually worn by younger children to support proper jaw alignment and growth.

Typical out-of-pocket cost: Varies depending on the treatment required

Plates: A device made of plastic, wire and springs designed to fit around the top or bottom teeth and slowly shift their position. Plates are usually recommended for younger children whose jaws are still growing.

Typical out-of-pocket cost: Varies depending on the treatment required

Palate expanders: A device that sits on the upper jaw, typically attached to the back teeth with metal rings. Palate expanders are used to widen the upper jaw and fix crowding.

Typical out-of-pocket cost: Varies depending on the treatment required

In some cases, orthodontic treatment also involves extractions. For example, adults who need braces will sometimes have one or more teeth removed first to make room for the remaining teeth to shift position.

This is because an adult’s jaw is no longer growing, which makes it more difficult to reposition the teeth – and it’s one of the big reasons dentists and orthodontists often recommend treatment earlier in life.

It does, but be aware that orthodontic treatment generally isn’t covered under health insurance hospital cover policies. If you’re looking for cover for the cost of orthodontic treatment for yourself or your children, you’ll usually need to include orthodontics in your extras cover.

Extras cover can be purchased on its own or packaged with hospital cover. In addition to orthodontics, extras cover can include treatments like general dental work, optical, physiotherapy and more. Exactly what’s covered and how much you get back depends on the policy and the insurer.

Usually, health insurance extras cover for dental treatment is split into three categories.

It’s worth noting that some funds will have combined major dental and orthodontics limits on what you can claim, while others will have separate limits:

In addition, some insurers offer orthodontics separately to major dental, while others will package the two together. It’s worth checking your policy to see how it’s structured as you may be paying for orthodontics when you no longer need it, for example if your children have grown up and left your policy.

Keep in mind that not all orthodontics cover is the same. Some policies cover orthodontics treatment up to just a few hundred dollars, while others pay over $2,500. Comparing extras policies can help you find the right level of cover for your situation.

An annual benefit limit is the maximum amount you can claim, per person, for orthodontic treatment in any one year of cover.

Some health insurers set a standard annual benefit limit for the entire policy period, while others accrue an annual benefit limit the longer you are covered by a policy.

Here’s an example of what an accrued annual benefit limit could look like, based on a policy with a starting limit of $400, which increases by $200 every year:

Annual benefit limits that accrue over time are known as ‘loyalty limits’.

The lifetime limit is the maximum amount you can claim, per person, for orthodontic treatment over your lifetime. For example, a lifetime limit of $2,400 means you can claim up to $2,400.

Lifetime limits usually range from around $1,000 to $2,800, which means there will usually be an out-of-pocket gap payment for orthodontic treatments.

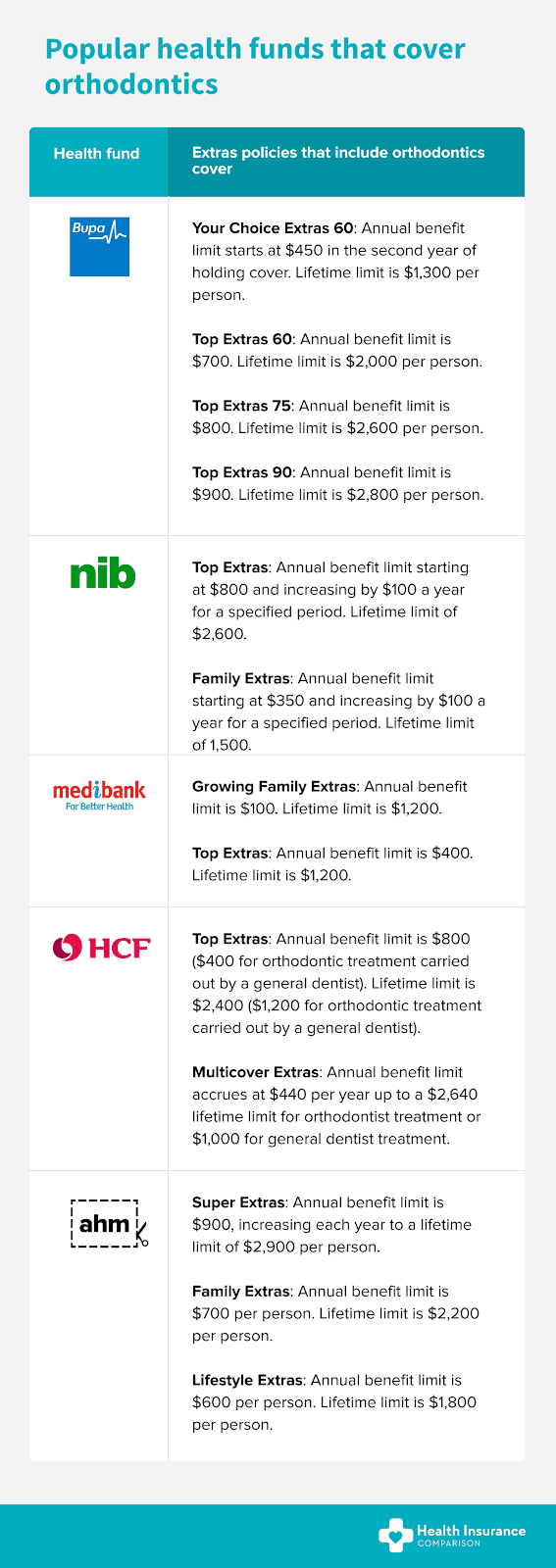

Below is a table of a selection of popular insurers – BUPA, nib, Medibank, HCF, ahm – and what orthodontics cover they offer customers.

Looking for more orthodontics cover options? Compare health insurance policies.

The standard waiting period for orthodontic treatment is 12 months. This means you’ll need to wait at least 12 months after taking out a health insurance policy with orthodontics cover before you can claim on treatment.

To make a claim, you’ll need to ask your orthodontist for a ‘treatment plan’. This plan should outline how long the treatment could take and how you will be paying for the cost of the treatment.

Once you have the treatment plan, you’ll need to give it to your health fund to start claiming benefits. There are two ways to pay and claim on treatment:

If you decide to switch policies while you’re in the middle of treatment, some funds may require you to serve the new waiting period (usually 12 months) before you can claim. Not all funds do this – some will let you continue to claim without serving waiting periods.

Where waiting periods will kick in regardless is if you upgrade your existing policy. For example, if you raise your annual limit from $400 to $500 or you’ve upgraded from a $2,000 lifetime limit to $2,800 then you’ll need to serve your new waiting periods for the higher limits.

If you decide to switch policies while you’re in the middle of treatment, you’ll need to serve the new waiting period (usually 12 months) before you can make a claim.

In most cases, if you’ve accrued a loyalty limit on your yearly benefit amount, it also won’t be carried over to your new policy.

This doesn’t mean switching is never a good idea: cover options change regularly, and finding a new policy could be more cost-effective in the long run. If you or somebody on your fund is in the middle of treatment, our expert team will try to find a policy that allows you to continue to claim.

If you’ve purchased orthodontics cover for your kids, remember to check your policy and see if they’re still covered. In most cases, insurers will stop providing cover for children after they turn 21 but it’s not uncommon for people to still be paying for extras they won’t need.

If you don’t need cover for orthodontics anymore, consider if it’s worth switching to another insurer. There are lots of options out there that could be cheaper and more suitable for your needs.

So, if you’re looking for new orthodontics cover or to review your current policy? Compare policies or give us a call on 1300 163 402 to talk to one of our health insurance specialists about finding cover that’s right for your situation and budget.

This guide is opinion only and should not be taken as medical or financial advice. Check with a financial professional before making any decisions.

* Source: Orthodontics Australia

Confused? Not sure if this applies to your situation? Phone us on 1300 163 402 for some free, no obligation advice.

Our experts can provide you with free personal advice. Let us call you.