Still have questions? Let's talk!

Confused? Not sure if this applies to your situation? Phone us on 1300 163 402 for some free, no obligation advice.

Purchasing private health insurance limits out-of-pocket costs and gives you broader choices than Medicare cover. If you are legally married, in a registered relationship or living in a de facto relationship, you have the option of either purchasing singles policies or purchasing a couple’s policy. There are advantages and disadvantages to each option and you need to carefully shop around for the health insurance fund that is right for you.

Contents

Couples in a homosexual or heterosexual marriage have the option to purchase couples cover, as do individuals living together in a de facto relationship. A couples policy refers to one health insurance policy that covers both partners. Each member of a couple may also purchase his or her own singles cover instead of purchasing couples cover.

Purchasing a couple’s policy has some advantages:

In Australia, you are eligible for couples cover provided that you are either :

A de facto relationship exists if two unmarried and unregistered partners live together in a romantic relationship. There is no minimum time period that you must live together before you are viewed as being in a de facto relationship.

The Australian government provides a rebate to most individuals who purchase private health insurance cover. This rebate is income tested. If you are in a registered relationship, are married or in a de facto relationship, you will be subject to the family income thresholds rather than the singles income thresholds when determining your income for purposes of rebates.

For those who make above a certain income and who do not have Hospital coverage, the Medicare Levy Surcharge also comes into play. Married and registered partners as well as people in a de facto relationship must combine their incomes and are subject to family tiers for purposes of assessing their Medicare Levy Surcharge.

The Australian government has a system in place called Lifetime Health Cover, which is designed to encourage young people to buy Hospital cover.

If you have purchased Hospital cover prior to age 30, you can lock in a lower rate. If you do not do this, you are subject to a two percent age loading for each year that you were aged over 30 and were without Hospital cover. For example, if you are 35 when taking out cover for the first time, you would incur a 10 percent age loading cost.

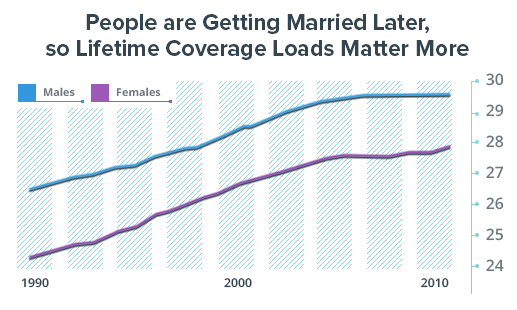

It is common for partners to be different ages and have different cover histories. If either party is over 30 and has not had prior Hospital cover, the age load cost must be considered when taking out a couples policy.

The age loading of each spouse or partner is averaged when a joint policy is purchased. For example, if the wife purchased insurance at age 25, she has no age loading. If the husband purchased cover at 35, he has a 10 percent age load cost. When a couples policy is purchased, there is an average load of five percent. The age load is dropped after 10 years of continuous Hospital cover.

When purchasing couples cover, the needs of both individuals need to be taken into account. These needs can change as you both age and experience life milestones.

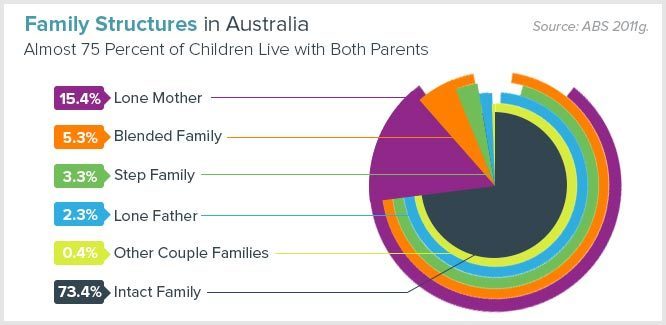

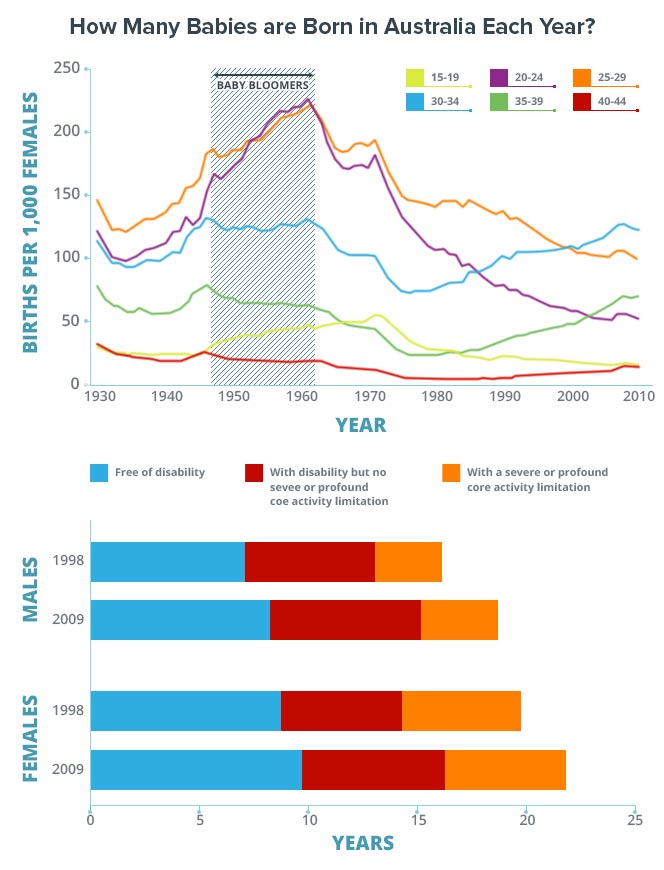

Younger couples often look for cover for obstetrics, fertility treatments and pregnancy. Premiums for policies covering pregnancy services may be higher and this cover can be dropped once you have had children. Most funds have a 12-month waiting period for pregnancy cover so planning ahead is essential if you are thinking about starting a family.

Once you have had children, purchasing family cover is important to provide needed health benefits for children. Children can be covered until age 21 on a family policy, or until age 25 provided they are student dependents.

After children leave home, you can return to a couples policy. For senior couples, pregnancy cover is no longer necessary. Extras services that senior couples may look for include hearing aids; chiropractic care; and home nursing care, for example.

Each partner’s individual needs may differ so couples should look for policies that have a combined annual limit and that permit each partner to select the Extras cover of their choosing.

Medicare provides cover for pregnancy only in public hospitals.

Private hospital cover provides broader cover for pregnancy and birth-related services. However, some health funds pay only restricted benefits that cover private patients in public hospitals. If you want to have your baby in a private hospital, you must look for a health fund policy that provides this cover.

Pregnancy cover can be purchased as part of a singles policy or as part of a couples policy. Not all policies for either singles or couples offer this cover.

All health funds have a 12 month waiting period before providing any type of cover for pregnancy. This means you must have cover for obstetrics treatments well before you fall pregnant.

Obstetrics cover generally provides payments only for pregnancy-related treatments and does not pay for medical care for the infant. Healthy babies are not formally admitted to a hospital so no charges are raised for their care. If the baby requires any treatment, however, he or she may be admitted as an in-patient and charges will apply.

For parents who have twins or multiple births, at least one baby is formally admitted to the hospital as a matter of policy. This results in out of pocket costs unless you have family cover.

Switching to family cover before the baby is born is advisable to protect your finances in the event that your infant incurs unexpected medical costs. Most funds require switching to a family level policy between one and three months prior to the birth of the baby.

Not all policies that provide obstetrics cover include assisted reproduction treatments like in vitro fertilization (IVF). Even when IVF is covered, typically only aspects of the treatment requiring admission to a hospital are paid for by hospital insurance. IVF treatment has multiple steps, many of which do not require hospital admissions. These outpatient treatments often need to be paid out of your own pocket. The standard waiting period for IVF cover is 12 months.

Health insurance rebates are available from the government to assist with the payment of health insurance premiums. Becoming a part of a couple affects your eligibility for health insurance coverage rebates.

Rebate amount is based on your income and there are different income thresholds for individuals versus couples/families. Anyone who is married, in a registered relationship or living in a de facto relationship is subject to family tiers. It is important to understand that living as a couple may affect your ability to claim rebates. Rebate tiers for individuals and families/couples are as follows:

| Singles Families |

$90,001-105,000 $180,001-210,000 |

$105,001-140,000 $210,001-280,000 |

||

|---|---|---|---|---|

| Rebate | ||||

| Standard | Tier 1 | Tier 2 | Tier 3 | |

| 25.059% | 16.706% | 8.352% | 0% | |

| Age 65-69 | 29.236% | 20.883% | 12.529% | 0% |

| Age 70+ | 33.413% | 25.059% | 16.706% | 0% |

Australia also charges a Medicare Levy Surcharge for higher income individuals who do not purchase Hospital cover. Individuals who are living in a couple relationship must use the family tier to determine if they are subject to a surcharge based on their combined income:

| Unchanged | Tier 1 | Tier 2 | Tier 3 | |

|---|---|---|---|---|

| Singles | $90,000 or less | $90,001-105,000 | $105,001-140,000 | $140,001 or more |

| Families | $180,000 or less | $180,001-210,000 | $210,001-280,000 | $280,001 or more |

| Medicare Levy Surcharge Rate |

0% | 1% | 1.25% | 1.5% |

Confused? Not sure if this applies to your situation? Phone us on 1300 163 402 for some free, no obligation advice.

Our experts can provide you with free personal advice. Let us call you.